ESG

China Minsheng Bank Supports National Policy on Distributed Photovoltaic Industry Through “Photovoltaic Loan”

-

In order to support the national policy on distributed photovoltaic (PV) industry and meet the financing needs of enterprises and farmers to purchase PV power generation (PPG) equipment, in recent years, a consumer loan product of “photovoltaic loan” has been launched for the purpose of guiding the transformation to green and low-carbon consumption, helping core PV manufacturers expand sales channels, facilitating the development of inclusive finance and green finance, and achieving win-win cooperation between "governments, enterprises and banks".

China Minsheng Bank issues RMB loans to qualified end customers of distributed PPG equipment to meet their financial needs for purchasing PPG equipment. Distributed PPG is usually installed near the location of users and generates power for users’ own use, or for supplying the excess power to the power grid, or purely for supplying the power grids. Distributed PPG systems can be built in rural areas, pastoral areas, mountainous areas, developing large, medium and small cities or locations near commercial areas, so as to meet the electric power demands of local users, while to generate power with renewable resources, reduce carbon emissions and facilitate environmental protection as it is pollution-free.

“Minsheng Photovoltaic Loan” mainly serves two types of customers: enterprises and public institutions, and individuals. Type one are the enterprises and public institutions, or core PV enterprises and their subsidiaries that wish to install PPG equipment on the roof of their own or rented buildings. Type two are individuals, mostly farmers in rural areas, who are willing to install PPG equipment on the roof of their own buildings.Type one are corporate customers, photovoltaic loans to whom only need to meet the existing project financing requirements. Type two are individual customers, photovoltaic loans to whom need to be designed in compliance with relevant regulatory requirements.

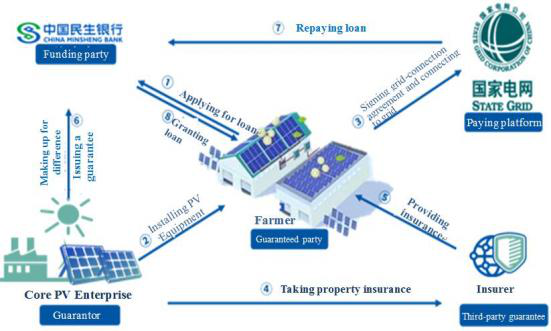

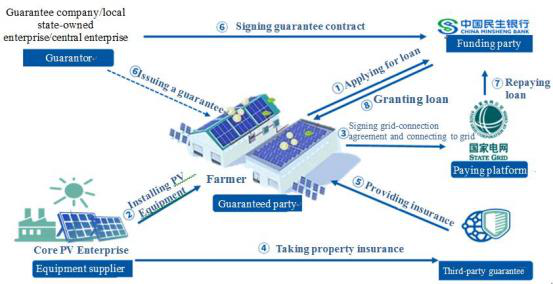

“Minsheng Photovoltaic Loan” adopts three major business models in serving individual customers. The three business models, as shown in Figure 1 below, are as follows: The first is core PV enterprise guarantee model, in which the core PV enterprise makes up for the price difference on a dynamic basis in the financing of distributed PV equipment of farmers; the second is core PV enterprise deposit guarantee model, in which the core PV enterprise makes a deposit of certain proportion of the loan amount granted and makes up for the price difference in the financing of distributed PV equipment of farmers; the third is third-party enterprise or institution guarantee model, in which professional guarantee companies, such as agricultural guarantee companies, provide guarantees for photovoltaic loans to farmers.

[Figure 1: Three major business models of “Minsheng Photovoltaic Loan” in serving individual customers]

Core PV Enterprise Guarantee Model

Core PV Enterprise Deposit Guarantee Model

Third-Party Enterprise or Institution Guarantee Model

After active exploration and practice, business features of “Minsheng Photovoltaic Loan” are reflected in the following aspects: Firstly, the maximum loan amount for a single household is up to RMB250 thousand, covering 100% of the equipment value, allowing farmers to install it without paying any money beforehand nor providing any collateral or pledge. Secondly, the business process is simple and fast. Minsheng small business finance App has integrated the functional module of “farmer photovoltaic loan” to realize full-online operation and management of photovoltaic loan business, real-time interaction of business data, visualized and controllable equipment status, and achieved the technological innovation of small business finance. Thirdly, the terms of photovoltaic loans can be extended up to 15 years, providing long-term financial assistance and benefits to farmers. The electricity fee will be distributed to farmers after total repayment, allowing farmers to obtain stable returns during the life cycle of the PV equipment.

“Minsheng Photovoltaic Loan” achieves the shift from C-end to B-end by facilitating farmers’ income growth and suppliers’ credit enhancement, and providing comprehensive financial services for core PV manufacturers. Starting with farmers but going beyond, China Minsheng Bank has built a relatively complete cooperation channel based on the resources of its own customers. Relying on the strategic customers of core PV manufacturers, and through close coordination and communication with governments, core enterprises and power grid companies, China Minsheng Bank has developed a diversified ecosystem integrating “governments, enterprises and banks”, actively expanded farmer customer resources to vigorously promote the photovoltaic loan business to farmers. Up to now, China Minsheng Bank has approved a batch credit lines of RMB20 million for the “Minsheng Photovoltaic Loan” to core PV manufacturers-related farmers, and will issue such loans to about 200 farmers in Zhejiang Province. In addition, China Minsheng Bank has granted over RMB50 million photovoltaic loans to over 500 farmers through its affiliated rural banks. It has reserved nearly RMB4 billion distributed power station related business of core PV enterprises and farmers. At present, the Bank has cooperated with 3 core PV manufacturers, and promoted photovoltaic loan business online in regions such as Zhejiang, Shandong, Hebei and Henan. The target amount of “Minsheng Photovoltaic Loan” to each manufacturer is RMB1 billion.

Meanwhile, China Minsheng Bank has realized system interconnection and data exchange through close cooperation with core PV manufacturers, allowing real-time acquisition of power generation data and operation and maintenance status of users' distributed PV equipment, dynamic monitoring of asset operation status and whole-process risk management and control.

Note: This case study was published with the title of Green Finance Supports High-Quality Development ofPhotovoltaic Industry in China Banking (Issue 5, 2022)

- About CMBC

- Introduction

- Board of Directors

- Board of Supervisors

- Management Team

- Organizational Chart